We do the research, you get the alpha!

Get exclusive reports and access to key insights on airdrops, NFTs, and more! Subscribe now to Alpha Reports and up your game!

Go to Alpha Reports

Blockchain data shows signs that the Bitcoin mining industry is “capitulating,” according to CryptoQuant—a likely precursor to Bitcoin tapping a local price bottom before surging to new highs.

CryptoQuant analyzed the metrics for miners, who are responsible for securing the Bitcoin network in exchange for newly issued BTC. As outlined in the market intelligence platform’s Wednesday report, multiple signs of capitulation flashed over the last month, during which time Bitcoin’s price dropped 13% from $68,791 to $59,603.

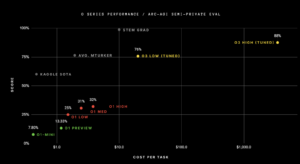

One of those signs includes a significant decline in Bitcoin’s hash rate, the total computational power securing Bitcoin. Since tapping a record-high at 623 exashashes per second (EH/s) on April 27, the hash rate has since receded 7.7% to 576 EH/s—its lowest figure in four months.

“Historically, an extreme hash rate drawdown has been associated with price bottoming conditions,” CryptoQuant wrote. Specifically, the 7.7% drawdown is reminiscent of an equivalent hash rate drawdown in December 2022, when Bitcoin’s price bottomed at $16,000 before surging more than 300% over the next 15 months.

This latest hash rate decline followed Bitcoin’s fourth cyclical “halving” event in April, cutting the number of coins paid out to miners in half. According to CryptoQuant’s miner profit/loss sustainability indicator, this has left miners “mostly extremely underpaid” since April 20, forcing many to turn off mining machines that had now turned unprofitable.

Miners have been struck with a 63% decline in daily revenues since the halving when both Bitcoin’s base block rewards and transaction fee revenue were far higher, CrypotoQuant said.

During this time, Bitcoin miners have been seen moving coins out of their on-chain wallets at a faster pace than usual, indicating that they may be selling their BTC reserves. “Daily miner outflows have spiked to the largest volume since May 21,” the firm wrote.

Between sales from Bitcoin miners, whales, and national governments, Bitcoin’s price pullback in June has also hurt Bitcoin’s “hash price”—a metric of Bitcoin miner profitability per unit of computational power.

“The average mining revenue by hash (hash price) continues to be near all-time low levels,” CryptoQuant wrote. “Hashprice stands at $0.049 per EH/s, just above the all-time hashprice low of $0.045 reached on May 1st.”

Edited by Ryan Ozawa.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.