IBIT and FBTC rank among top global ETFs by inflows

Key Takeaways

BlackRock’s IBIT and Fidelity’s FBTC rank among top 15 global ETFs for inflows in 2024.

US spot crypto ETFs represent 1.9% of total global flows, with Bitcoin ETFs outperforming Ethereum ETFs.

Share this article

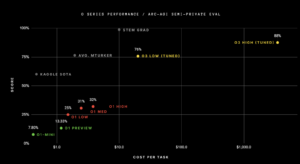

Spot crypto exchange-traded funds (ETF) in the US represent nearly 1.9% of the total global flows year-to-date, with BlackRock’s IBIT and Fidelity’s FBTC among the Top 15.

Bloomberg senior ETF analyst Eric Balchunas shared that global ETF year-to-date flows are at $911 billion. BlackRock’s spot Bitcoin (BTC) ETF IBIT is in third place, with roughly $20.5 billion in flows, bested only by Vanguard S&P 500 ETF (VOO) and its own iShares Core S&P 500 ETF.

Meanwhile, Fidelity’s FBTC registered $9.8 billion and bolsters the 14th largest amount of inflows.

According to Farside Investors’ data, US-traded spot Bitcoin ETFs amount to $17.5 billion in net flows in 2024. However, they are diminished by the $440 million of outflows registered so far by spot Ethereum (ETH) ETFs.

Balchunas is an active voice when it comes to praising the performance of the spot Bitcoin ETFs launched this year, both in volume and inflows. In March, the analyst voiced his surprise when the BTC ETFs surpassed $10 billion in daily volume. “These are bananas numbers for ETfs under 2mo old.”

Moreover, during the early July price crash caused by the German government selling nearly 50,000 BTC, Balchunas was again taken aback when Bitcoin ETFs registered positive net flows on daily, weekly, and monthly timeframes.

Ethereum ETFs pressured by different factors

As reported by Crypto Briefing, BlackRock’s Ethereum ETF ETHA surpassed $1 billion in inflows yesterday. This is a major milestone to hit as spot Ethereum ETFs are nearing one month since launch.

Yet, these funds’ performance is still lackluster when compared to the resilience shown by Bitcoin ETFs. In the latest edition of the “Bitfinex Alpha” report, Bitfinex analysts point out different reasons behind this disparity.

The first is the selling pressure created by market maker Jump Trading, which offloaded over 83,000 ETH in the market as of Aug. 9. Additionally, Wintermute and Flow Traders have also sold Ethereum, which raises the total amount dumped to 130,000 ETH.

Notably, these selling movements come as the market faces a liquidity crunch, making it harder to absorb large ETH dumps. Furthermore, Grayscale’s ETHE nearly $2.5 billion in outflows is another significant factor holding Ethereum ETFs down.

Lastly, the sudden interest rate increase in Japan, the uncertainty around the US presidential election outcome, and the Middle East tensions paint a macroeconomic picture that dampens the risk appetite, directly impacting ETH’s performance.

As a result, investors seem to avoid ETH for the time being and thus have a direct influence over Ethereum ETFs’ net flows.

Share this article