Crypto funds see $3.2 billion inflows in July amid bullish investor sentiment

Key Takeaways

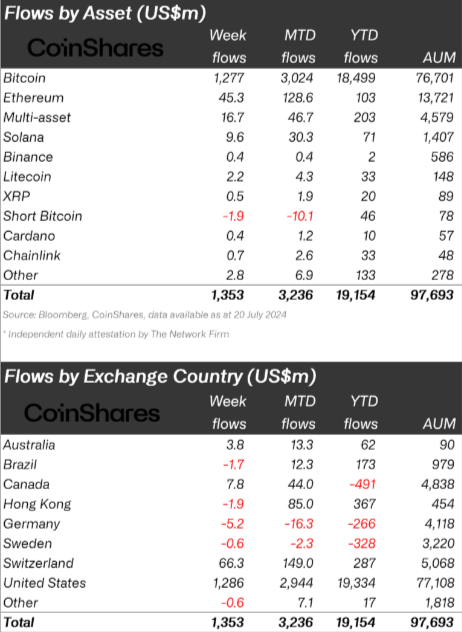

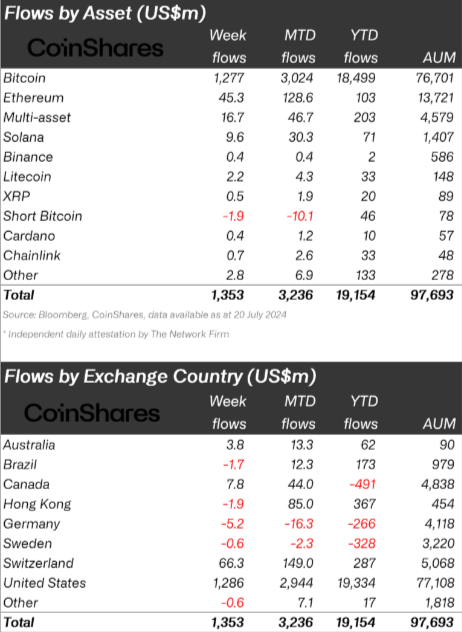

Digital asset investment products saw $1.35bn inflows last week, totaling $3.2bn over three weeks.

Ethereum surpassed Solana in year-to-date inflows, reaching $103m compared to Solana’s $71m.

Share this article

![]()

Crypto products saw inflows of $1.35 billion last week, bringing the total inflows over the last three weeks to $3.2 billion, according to asset management firm CoinShares.

Bitcoin dominated with $1.27 billion in inflows, while short Bitcoin products saw outflows of $1.9 million. Since March, short Bitcoin exchange-traded products (ETP) have experienced outflows totaling $44 million, representing 56% of assets under management.

Ethereum saw $45 million in inflows, surpassing Solana as the altcoin with the most inflows year-to-date at $103 million. Solana attracted $9.6 million in inflows last week, bringing its year-to-date total to $71 million. A noteworthy mention is Litecoin, which also saw inflows of $2.2 million.

Moreover, crypto funds indexed to digital assets’ baskets saw $16.7 million in weekly inflows, signaling an appetite for diversification from investors.

Regionally, the US and Switzerland led regional inflows with $1.3 billion and $66 million respectively, while Brazil and Hong Kong experienced minor outflows of $1.7 million and $1.9 million.

Notably, Brazil only saw two weeks of net outflows this year, making it the fourth-largest country on year-to-date assets under management.

ETP trading volumes increased by 45% week-on-week to $12.9 billion, representing 22% of the broader crypto market volumes. In contrast, blockchain equities experienced outflows of $8.5 million last week, despite most ETFs outperforming world equity indices.

Share this article

![]()